Say Goodbye to Card Payments: Palm Pay Revolutionizes Purchases in the UAE

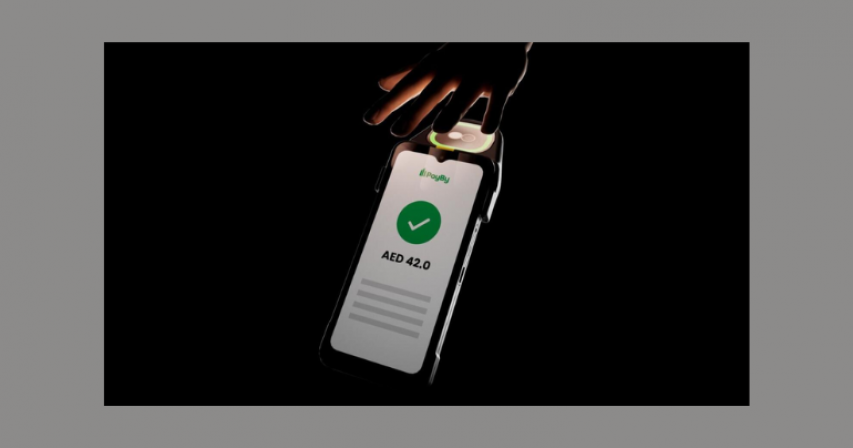

In a move set to transform the way transactions are made, the UAE is introducing Palm Pay, a revolutionary payment solution that allows users to make purchases simply by waving their palms. Developed by Astra Tech's fintech subsidiary, PayBy, Palm Pay is poised to revolutionize the payment landscape in the country.

Abdallah Abu Sheikh, the founder of Astra Tech, revealed that the rollout of Palm Pay technology will be gradual throughout 2024, with plans to scale up to over 50,000 merchants by the end of the year. This contactless palm recognition service utilizes biometric authentication methods, enabling secure and seamless transactions without the need for traditional bank cards or smartphones.

The process is simple: customers' palm prints are read by payment machines to authenticate transactions, eliminating the need for swiping cards or tapping phones at cash counters. This innovative technology not only enhances convenience but also offers a more secure alternative to traditional payment methods.

One of the key features of Palm Pay is its integration with existing point of sale systems, allowing merchants to easily adopt the technology. Early adopters interested in implementing Palm Pay can contact their account managers to sign up and express their interest in receiving the technology.

Furthermore, Palm Pay is designed to be user-friendly and accessible to all. The registration process for users is free and straightforward. In the initial phase, users can register through the device itself at the point of sale. In the future, the palm authentication process will be integrated into apps like PayBy and Botim, allowing customers to easily update their accounts with their palm prints through an authentication feature on their phone.

Palm Pay holds strong potential across various sectors, particularly in high-traffic industries such as retail. However, its benefits extend beyond convenience; it also promotes financial inclusion for the unbanked population by offering a cost-effective solution for merchants.

As the UAE continues to drive innovation and embrace technological advancements, Palm Pay emerges as a game-changer in the realm of digital payments. With its secure, convenient, and accessible features, Palm Pay is set to redefine the way transactions are conducted, paving the way for a future where cashless payments are the norm.

By: Sahiba Suri

Comments