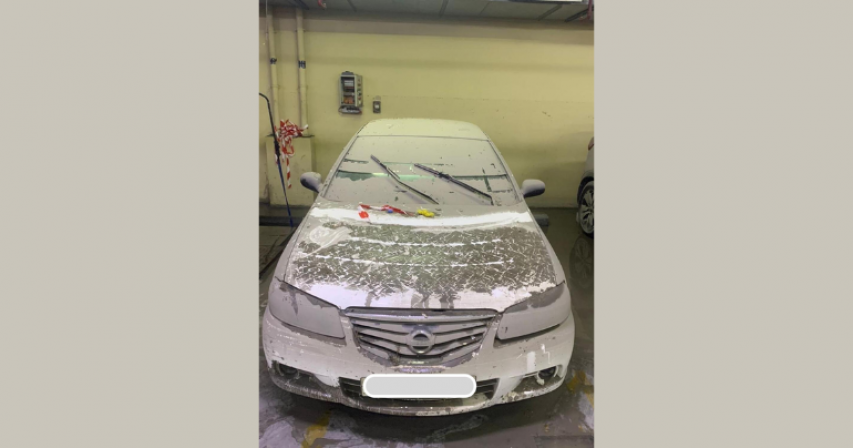

12 years' worth of car insurance claims made within few days in April

April's thunderstorms in the UAE triggered an unprecedented surge in car insurance claims, equivalent to 12 years' worth in just a few days. The downpour affected an estimated 100,000 vehicles, many rendered irreparable. Insurance brokers and providers grappled with the aftermath, managing a flood of claims and delays in processing. Authorities, led by the Central Bank of the UAE, oversaw the response, emphasizing the need for patience amid the overwhelming demand for insurance services.

The aftermath of the record-breaking weather event prompted insurers to assess damages and expedite claims processing. Karan Mulani, a business development manager at Pioneer Insurance Brokers, highlighted the staggering volume of claims, underscoring the significant impact on motorists and insurance providers alike. Susan Manalaysay Francisco, another insurance specialist, echoed Mulani's observations, emphasizing the challenges posed by the deluge of claims and the logistical hurdles faced by insurers.

Muhammad Irfan Usman, also from Pioneer Insurance Brokers, provided insights into the ongoing efforts to address the high volume of claims. Despite the challenges, insurance companies reassured policyholders of their commitment to resolving claims promptly. Neeraj Gupta, CEO at Policybazaar.ae, shed light on the complexities of claims processing, urging customers to remain vigilant and proactive throughout the process.

As insurers grappled with the aftermath of the thunderstorms, motorists faced the prospect of increased insurance premiums. Gupta highlighted a significant uptick in premium rates following the weather disturbance, attributing the hike to heightened risk perceptions among insurers. However, not all insurance sectors experienced premium hikes, offering some relief to homeowners.

Looking ahead, insurers may recalibrate their risk assessments and pricing strategies in response to the unprecedented rainfall. Gupta anticipated potential adjustments in premium rates and risk assessments, particularly for properties situated in flood-prone areas. The insurance landscape, shaped by the recent weather event, underscores the dynamic interplay between natural disasters, risk management, and insurance coverage.

Amid the challenges posed by April's thunderstorms, stakeholders across the insurance sector mobilized to address the needs of affected motorists and homeowners. The surge in claims served as a stark reminder of the importance of comprehensive insurance coverage and preparedness for unforeseen weather events. As insurers navigate the aftermath of the record-breaking rainfall, the resilience of the insurance industry and its ability to adapt to evolving risk landscapes will be put to the test.

By: Sahiba Suri

Comments