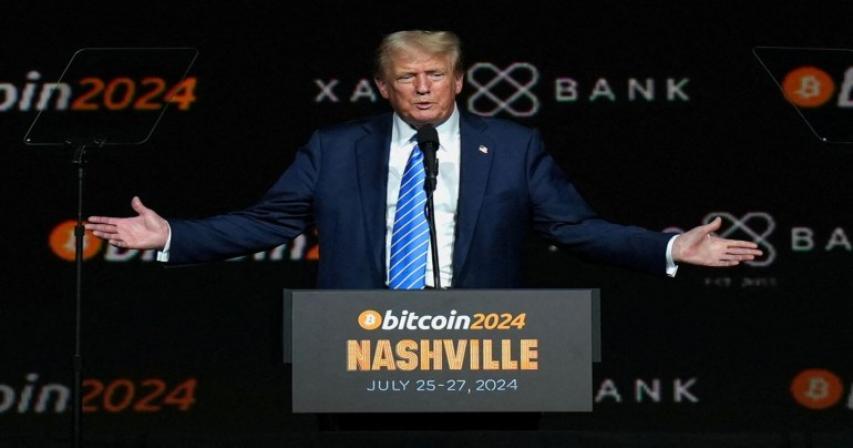

UAE: Bitcoin could reach $150,000 as Trump returns as US President

Bitcoin could reach $150k by 2025’s end based on institutional interest and the backing of the US president-elect Donald Trump for cryptocurrencies, forex executives say.

But, there are some that say Bitcoin will need to stay over $100,000 for a few months before that becomes a stop loss for the cryptocurrency.

Bitcoin broke $100,000 just a couple of days ago, but it crashed back below this psychological pivot point. It spiked again after Trump introduced his own cryptocurrency and news that he is about to issue an executive order to nationalize crypto.

"Institutions and retail customers are using crypto to cover inflation, risks and other risks in a very large scale as they used to with gold. The election of Donald Trump is a good thing. There are cyclical phenomena with the cryptocurrency industry, people are changing their mind from Bitcoin to Ethereum and others", said Konstantinos Chrysikos, director of customer relations at Kudo Trade.

"I anticipate Bitcoin to pool around $110,000-$120,000 before hitting $150,000 at some point around 2025. This is very conservative,’ he said, and continued: "You can hear us talking nuts but we have seen nuts happen in Bitcoin and cryptos that no one could believe.

As far as Farah Mourad, senior market analyst at Equiti Group, cryptos have been helped by Trump’s backing and some overseas Chinese-China crypto-to-crypto transactions.

"Bitcoin is not heading into a correction, but should one exist I think it’s going to be old highs $72,000-$75,000 as the level of support. But in case that’s a continuation, cryptocurrency might be benefited by weak dollar or gold and so on. To know that it is not dead, I have to see Bitcoin tumbling months above $100K. For as long as $100,000 is being cracked countless times I wouldn’t say anything. It is always good to diversify to Ethereum and Ripple," she added.

Exness senior market strategist Wael Makarem believes cryptos have surged thanks to reduced active supply.

"We have to keep a lid on active supply. I don’t believe everybody should be so bullish about the market when Trump comes into office because we have a bad ways of dealing with our counterparts (EU and China) because this is going to cause a mess in the market and take us for a risk," he said.

$120,000 for Makarem is an immediate target, as if active supply goes down quickly the volume becomes exponential so it’s easy to hit. "Just this past week we witnessed Bitcoin go from $88,000 to $97,000 in such a short time," he continued.

So will the dollar decline or rise?

Furthermore, the US dollar will get a boost too when Trump is elected again on January 20, 2025.

Wael Makarem said Trump causes market volatility and the market just drank what they drank the last 2 weeks when you had headlines on tariffs.

"The market is betting on the tariffs that could prop up the dollar. We don’t need the safe haven dollar, we don’t need tariffs and a belligerent attitude, everyone will trade the dollar for something else as we have seen recently the euro and other currencies came back to the greenback. Market may also react to Fed rate hikes."

Most importantly, he added, the dollar is strengthening because the rest of the world is getting weaker. "In Europe and the UK for instance, the euro and pound cannot help while the US economy is being sold concurrently", said Makarem.

The greenback gained due to Trump’s election, says Farah Mourad, also because the other currencies have weakening due to a weak eurozone growth and problems with the UK economy.

Kudo Trade’s Konstantinos Chrysikos predicts 5 to 10 per cent rise of the greenback this year, mainly on the US president’s policy and tariff war.

Comments